Investing

The moment that I turned 18 I became eligible to start investing and trading stocks. I really liked the idea of letting my money grow instead of sit in the bank and nearly no interest. I started my Robinhood account and became super interested. In the beginning I was trying to do a lot of trading to make short term gains all while trying to time the market. Let's just say it was not such a great strategy. I started reading and learning from other famous investors and learned that there is a difference between trading and investing and they are two completely different things. Now the majority of my money is invested in index funds and a few other stocks I feel like could have potential to grow. Below I will list them and tell a little about them.

My Portfolio

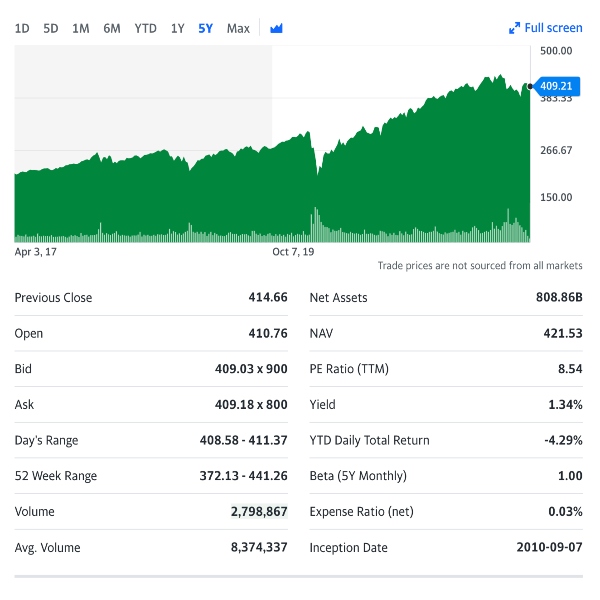

VOO

VOO is the Vanguard S&P 500 ETF and it tracks the market-cap weighted index of US large-cap and mid-cap stocks selected by the S&P Committee. This index fund is primarily tech heavy.

Top 10 Holdings

- Apple

- Microsoft

- Amazon

- Alphabet Class A

- Alphabet Class C

- Tesla

- NVIDIA

- Berkshire Hathaway

- Meta Platforms

- United Health

These top 10 holdings account for 28.44% of total assets.

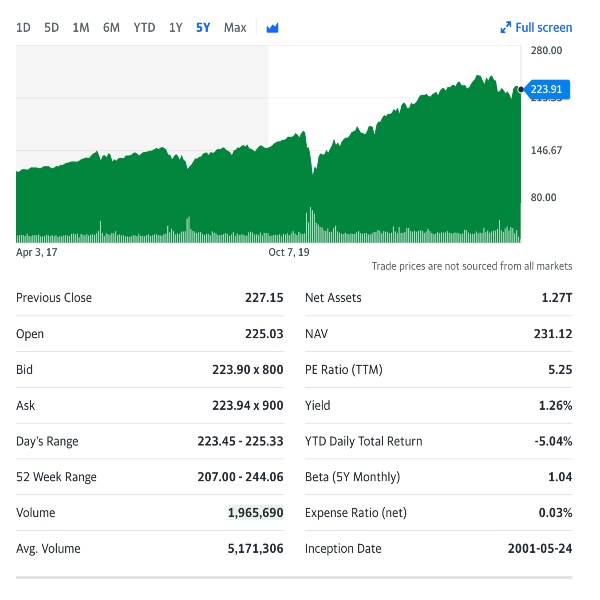

VTI

VTI is the Vanguard Total Stock Market ETF and it tracks a cap-weighted index that measures the investible US equities market, encompassing the entire market-cap spectrum. Just like VOO, VTI is primarily tech heavy.

Top 10 Holdings

- Apple

- Microsoft

- Amazon

- Alphabet Class A

- Alphabet Class C

- Tesla

- NVIDIA

- Berkshire Hathaway

- Meta Platforms

- United Health

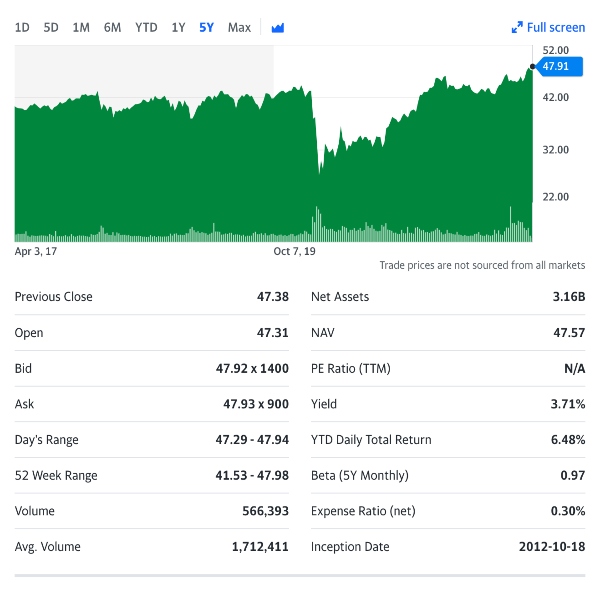

SPHD

SPHD is the Invesco S&P 500 High Dividend Low Volatility ETF,that tracks a dividend-yield weighted index comprising the least volatile, highest dividend-yielding S&P 500 stocks. SPHD is primarily comprised of utility companies.

- Williams Cos.

- Kinder Morgan

- Altria

- Chevron

- PPL

- Pinnacle West

- AT&T

- Philip Morris

- IBM

- Kraft Foods

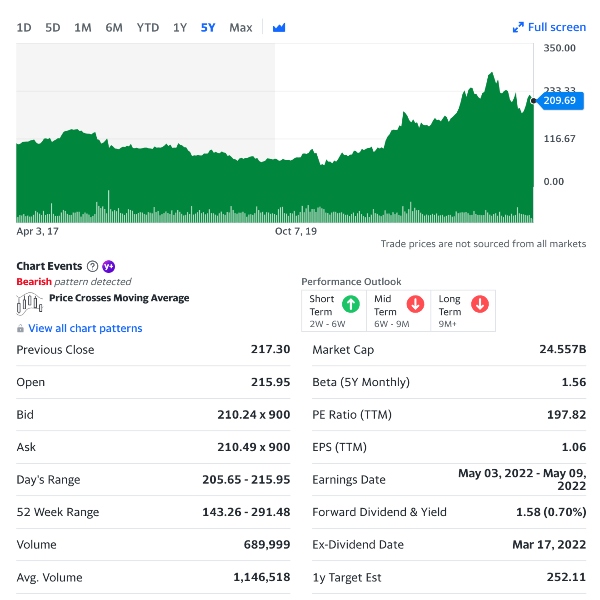

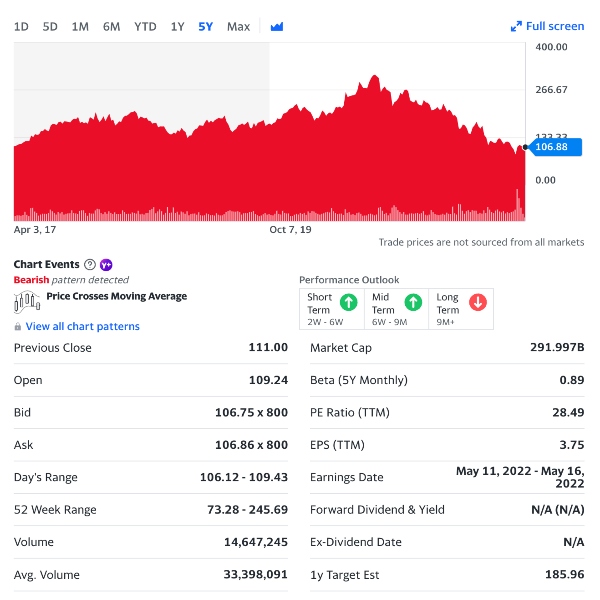

ALB

Albemarle Corp. engages in the development, manufacture, and marketing of chemicals for consumer electronics, petroleum refining, utilities, packaging, construction, transportation, pharmaceuticals, crop production, food-safety, and custom chemistry services. It operates through the following segments: Lithium, Bromine, Catalysts, and All Other. The Lithium segment develops and manufactures basic lithium compounds, including lithium carbonate, lithium hydroxide, lithium chloride, and value-added lithium specialties and reagents. The Bromine segment consists of bromine and bromine-based businesses including products used in fire safety solutions and other specialty chemicals applications. The Catalysts segment contains two product lines: clean fuel technologies, which are primarily composed of hydro processing catalysts, and heavy oil upgrading that is composed of fluidized catalytic cracking catalysts and additives. The All Other segment includes the FCS business. The company was founded in 1993 and is headquartered in Charlotte, NC. The listed name for ALB is Albemarle Corporation.

BABA

Alibaba Group Holding Ltd. engages in providing online and mobile marketplaces in retail and wholesale trade. It operates through the following business segments: Core Commerce, Cloud Computing, Digital Media & Entertainment, and Innovation Initiatives and Others. The Core Commerce segment consists of platforms operating in retail and wholesale. The Cloud Computing segment consists of Alibaba Cloud, which offers a complete suite of cloud services, including elastic computing, database, storage, network virtualization, large scale computing, security, management and application, big data analytics, a machine learning platform and Internet of Things (IoT) services. The Digital Media & Entertainment segment relates to the Youko Tudou and UC Browser businesses. The Innovation Initiatives and Others segment includes businesses such as AutoNavi, DingTalk, and Tmall Genie. The company was founded by Chung Tsai and Yun Ma on June 28, 1999 and is headquartered in Hangzhou, China. The listed name for BABA is Alibaba Group Holding Limited American Depositary Shares, each represents eight Ordinary Shares.

Not to rant at all, but Alibaba was not a so good stock purchase. When I purchased it was at its all time low at around $200. The novice investor in me said" it is low it has to go up". Well... Let's Just say that did not happen and it has been on a long ride to the bottom of the rollercoaster. I am really hoping that we are going to hit the bottom soon and begin the climb up. Only time will tell.

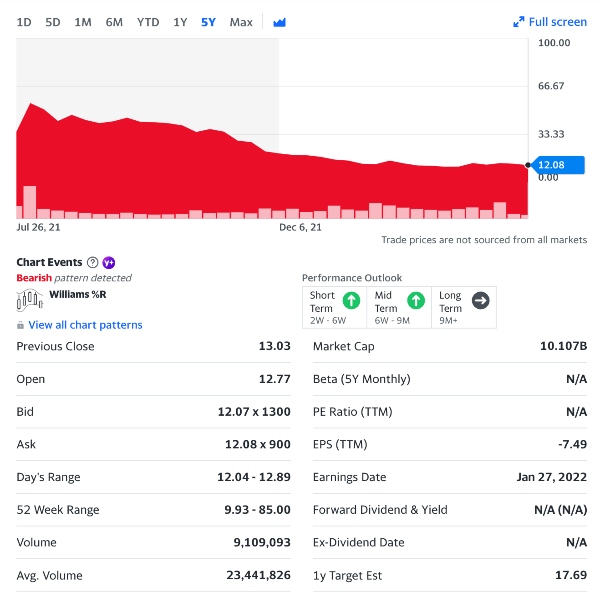

HOOD

Robinhood Markets, Inc is a financial services platform that pioneered commission-free stock trading with no account minimums and fractional share trading. The firm is focused on providing retail brokerage and offers trading in U.S. listed stocks and Exchange Traded Funds, related options, and cryptocurrency trading, as well as cash management, which includes debit cards services. The company was founded by Vladimir Tenev and Baiju Prafulkumar Bhatt in 2013 and is headquartered in Menlo Park, CA. The listed name for HOOD is Robinhood Markets, Inc. Class A Common Stock.

I bought shares in Robinhood at its IPO. The next day when the market opened it went crazy! Shares stated at $45 and within an hour of the market opening they were up to $85. Most exchanges had to halt trading. Robinhood was still allowing it and I was about to cash out at $80 a share, but then my parents told me to just hold on for the long run. Listening to my parents was a big mistake to say the least. As of now Robinhood is trading at $25 a share. It was a big "L" to say the least